Tax Roll Module

This guide is intended primarily for the user of SIGTAS. It details the procedures and functionalities enabling the user to register all taxpayers (individuals, legal entities or sole proprietorships). It explains how to add, modify or delete family data, identification documents, banking information, institutions, etc. It demonstrates how to validate and verify registration requests, how to make certificate requests or how to report on statistics, property rights, or businesses, to name only a few.

This guide is intended primarily for the user of SIGTAS. It details the procedures and functionalities enabling the user to register all taxpayers (individuals, legal entities or sole proprietorships). It explains how to add, modify or delete family data, identification documents, banking information, institutions, etc. It demonstrates how to validate and verify registration requests, how to make certificate requests or how to report on statistics, property rights, or businesses, to name only a few.

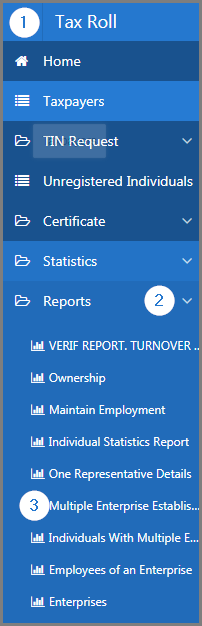

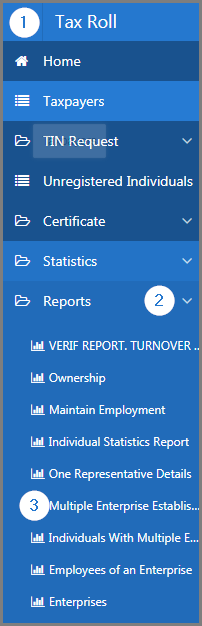

This module is composed of several large sections. Each section is treated individually and presents the main functionalities of the component. This page displays all the functionalities available in the Tax Roll module. The display order of the sections corresponds to that of SIGTAS (left section of the home menu).

In order to lighten the content of the guides, the following sections do not document the procedures for closing, modifying, and deleting, since they apply the same way to all pages. However, these functionnalities are described in more detail in the Close, Edit, and Delete section of the About SIGTAS guide.

To access guides, click on the desired link.

Reports

SIGTAS provides users with a series of interactive reports allowing the user to generate data according to various parameters. To learn how to generate and print interactive reports, click the following link: Reports

To access the reports:

- Go to the Tax Roll module;

- Choose the Reports menu;

- Click on the report to be displayed.

The reports from the Tax Roll module are:

- Employees of an Enterprise. This report is used to make a printout of all the employees of an enterprise according to various criteria such as All Enterprises of TIN (companies with a common TIN), Establishment, etc. (501:8011);

- Enterprises. This interactive report displays companies based on various search criteria, such as TIN, Enterprise Type, etc. (501:8016);

- Individuals With Multiple Employers. This report is used to print employees with more than one employer based on Start Date and End Date (501:8008);

- Individual Statistics Report. This report is used to print the statistics of individual taxpayers based on Nationality (501:8004);

- Maintain Employment. This interactive report displays employees based on various criteria, such as Employee TIN, National ID No., etc. (501:8003);

- Multiple Enterprise-Establishment.This report is used to print multiple establishments and businesses based on Tax Division and Reprt Name (501:8006);

- One Representative Details. This report is used to print the details of representatives based on TIN and Tax Agent No. (501:8007);

- Ownership. This interactive report displays ownership rights based on various criteria, such as Taxpayer Type, Start Date, End Date, etc. (501:8002);

- VERIF REPORT. Turnover (VAT and IR / IS). This interactive report displays turnover based on Reference Year and Tax Division (501:8001).

This guide is intended primarily for the user of SIGTAS. It details the procedures and functionalities enabling the user to register all taxpayers (individuals, legal entities or sole proprietorships). It explains how to add, modify or delete family data, identification documents, banking information, institutions, etc. It demonstrates how to validate and verify registration requests, how to make certificate requests or how to report on statistics, property rights, or businesses, to name only a few.

This guide is intended primarily for the user of SIGTAS. It details the procedures and functionalities enabling the user to register all taxpayers (individuals, legal entities or sole proprietorships). It explains how to add, modify or delete family data, identification documents, banking information, institutions, etc. It demonstrates how to validate and verify registration requests, how to make certificate requests or how to report on statistics, property rights, or businesses, to name only a few.