Add a tax lien to a collection case

This part of the guide explains how to create liens from the taxpayer's assets.

This functionality enables the user to secure assessments and/or overdue opening balances payments. The seizure of the taxpayer's assets is done in the Maintain Asset page (501:4001) of the Tax Roll module. Once registered, a lien cannot be deleted. However, the user can associate a closing date and choose a closing reason.

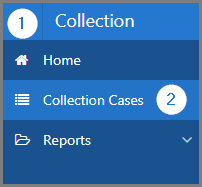

Step 1 - Go to the page List of Collection Case

- Go to the Collection module;

- Choose the Collection Cases menu. This action opens the List of Collection Cases page (520:2001);

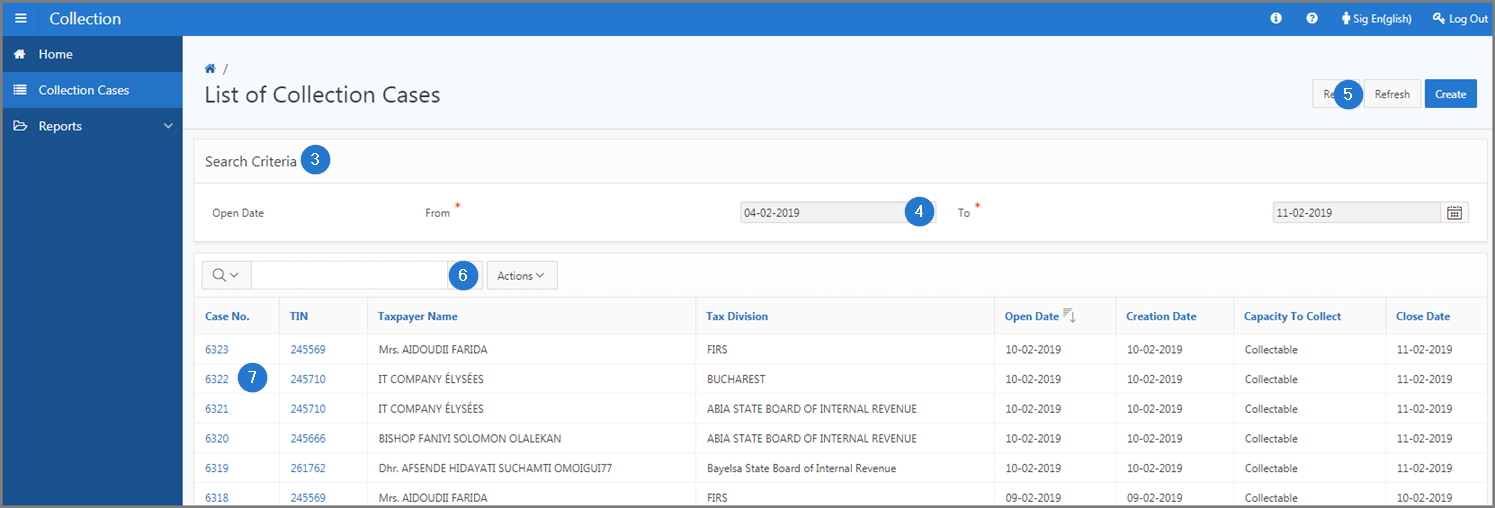

Step 2 - Display the asset of a collection case

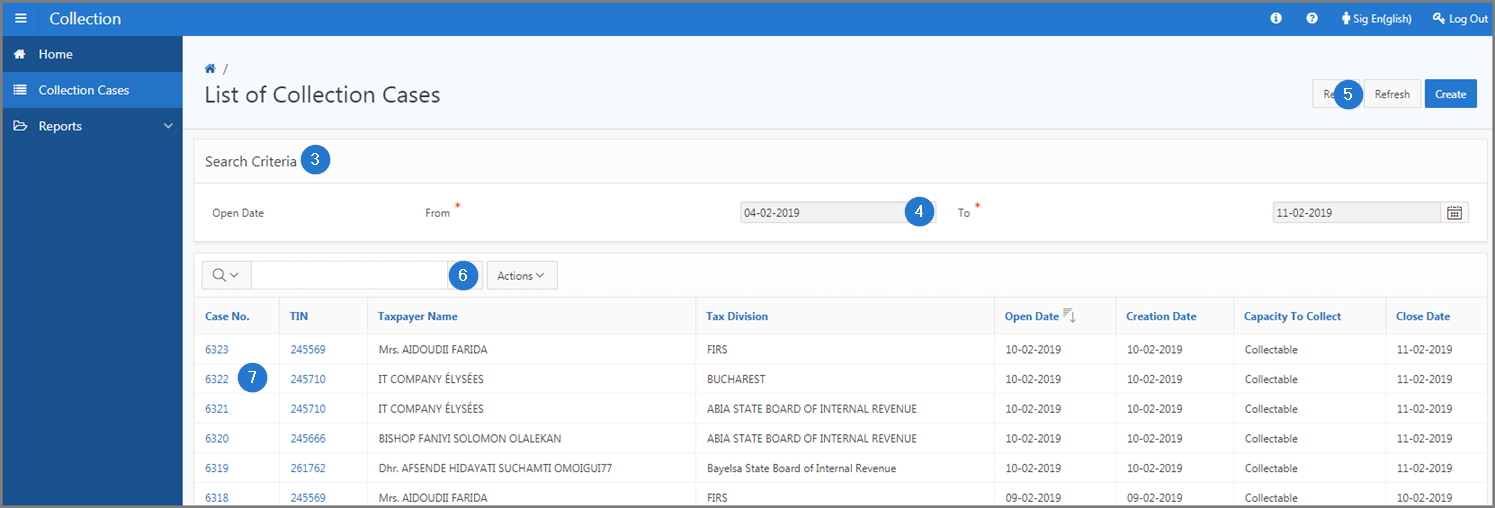

- Go to the Search Criteria section;

- Fill out the required fields (identified by a red asterisk *). For example, Opening Date From, To, etc.;

- Click the Refresh button. This action refreshes the page and displays the list of collection cases;

- Find the collection case;

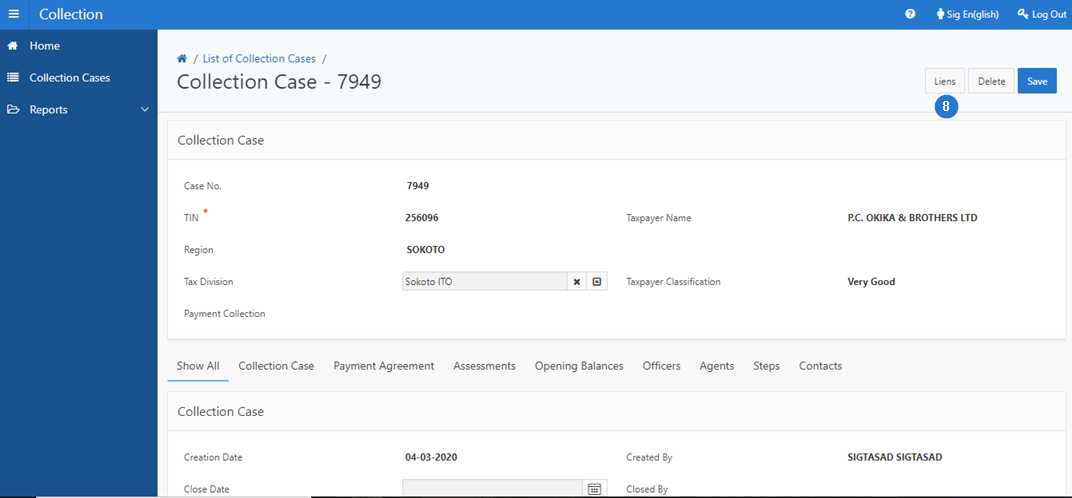

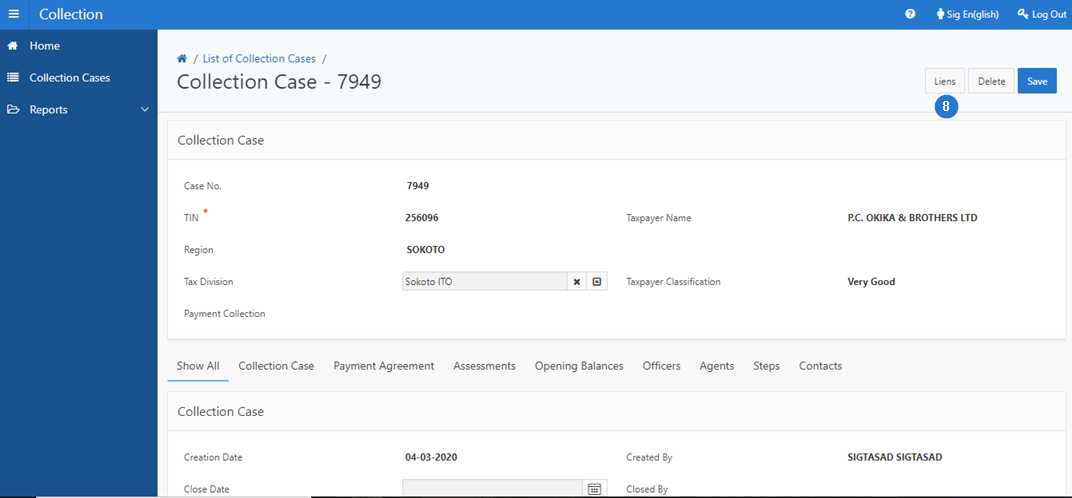

- Click the hyperlink of the Case No. subject of the request. This action opens the Collection Cases page (520:1001);

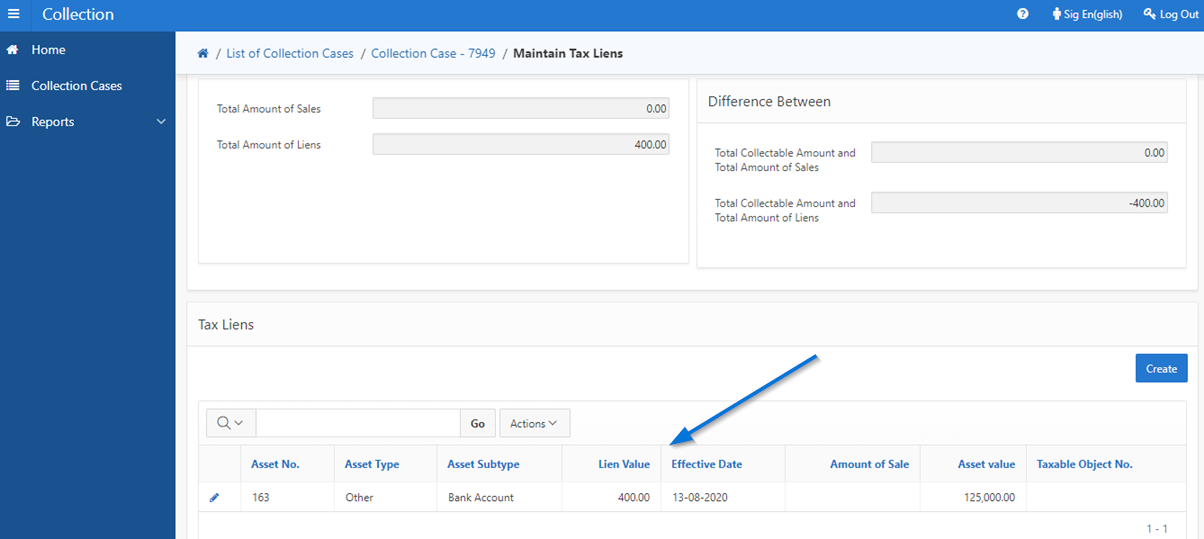

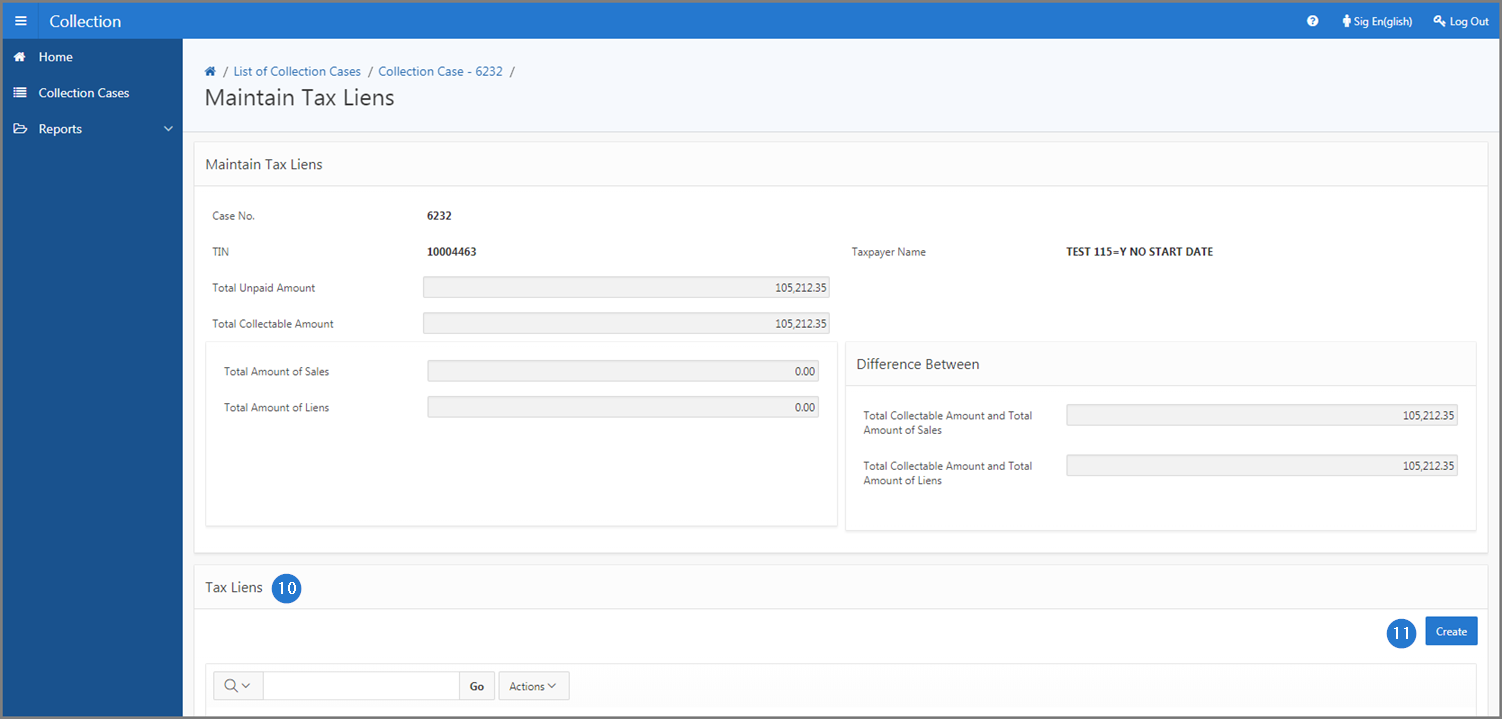

- Click the Liens button. This action opens the page Maintain Tax Liens page (520:1002);

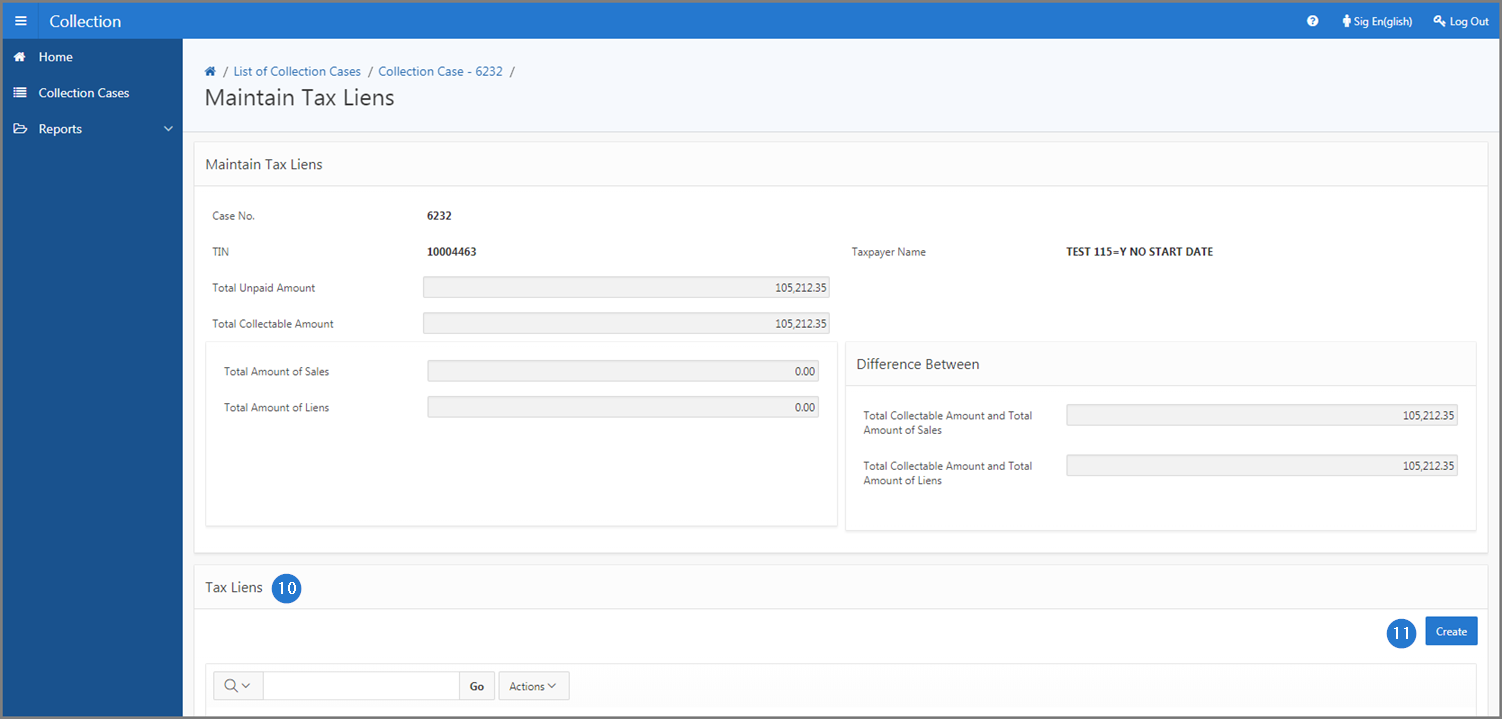

- Go to the Tax Liens section;

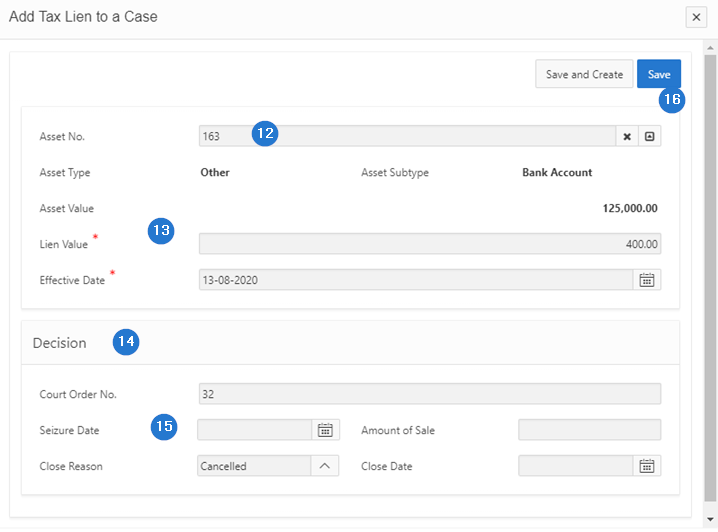

- Click the Create button. This action opens the pop-up window Add Tax Lien to a Case;

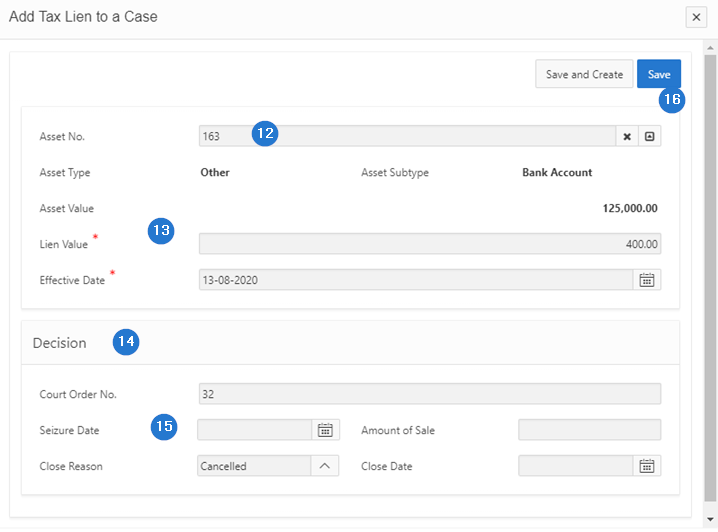

- Complete the Asset No. field. If it is empty, it means that no assets are saved to the taxpayer's file;

- Fill out the required fields (identified by a red asterisk *). For example, Lien Value, etc.;

- Go to the Decision section;

- Complete the fields, as applicable;

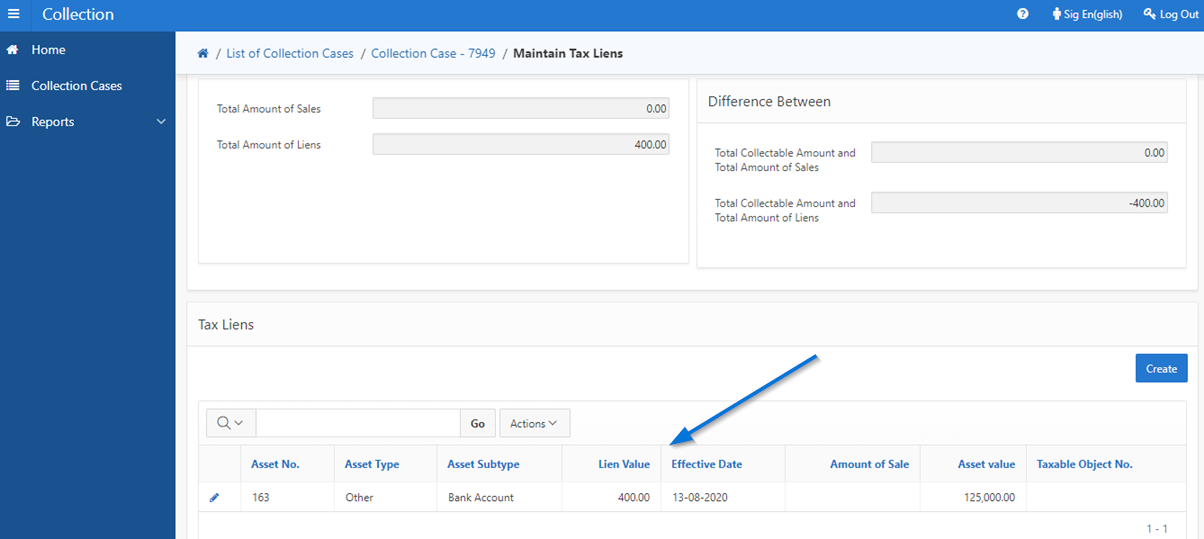

- Click the Save button. This action confirms the addition of a privilege and refreshes the page Maintain Tax Liens (520:1002).